The Indian paint industry has grown at a double-digit CAGR over the last two decades.(Representational)

These paint companies have grown their sales and profits at a faster pace than the market, in the last five years.

Updated: November 21, 2022 1:23 pm IST

Paint stocks have been on a downtrend right from the start of 2022.

Rising crude oil prices have led to a fall in paint stocks. Crude oil is an important raw material for the paint industry. It constitutes nearly half of the raw materials used in manufacturing paint.

Apart from this, the rising competition in the industry after Grasim announced its foray has also contributed to the fall.

Despite all this, the paint industry is set to grow in the coming years mainly due to the infrastructure push by the government and rising construction activity in the country.

That is why, you should keep the best paint stocks which offer consistent growth, on your watchlist.

Let’s take a look at the top 3 paint companies in India by growth.

We have shortlisted the companies by filtering them the basis of consistency in revenue and earnings growth using the Equitymaster Indian stocks screener.

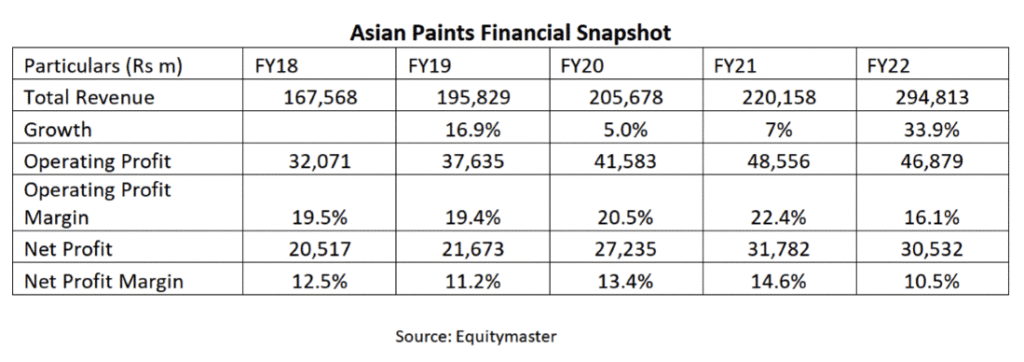

#1 Asian Paints

First on our list in Asian Paints.

From humble beginnings in a small garage in the year 1942, Asian Paints became the largest paint company in 1967, and has maintained its leadership position for the last 55 years.

Asian Paints is one of the finest paint companies in India. It manufactures various products, including varnishes, enamels, lacquers, surfacing preparation, organic composite solvents, and thinners.

It serves customers in more than 60 countries across the globe.

In the last five years, the company’s revenue and profit have grown at a compound annual growth rate (CAGR) of 12% and 8.3%, respectively.

The growth was primarily led by volume growth across product categories and segments.

The company is known for its supply chain strategy. It removed all channel partners and reached out to paint dealers and mom-and-pop stores directly to sell its products.

Today the company has more than 145,000 touchpoints in India and over 70,000 dealers selling its products in India.

An extended market reach could be why Asian Paints has close to 50% market share in the organized market.

The company has always focused on innovation. In financial year 2022, it launched 29 new products and has 17 new patents on its name.

After establishing itself in the paint industry, Asian Paints has also successfully ventured into the home décor and interior design business. Going forward, a strong festive and wedding season demand and easing inflation will drive its revenue and profit growth.

Here’s another mind-boggling stat on why Asian Paints is considered one of India’s best franchises.

The company has earned an ROE (Return on Equity) of at least 20% in each of the last 10 years. This makes it one of the only 100 companies in a universe of close to 4,000 to have achieved this feat.

Think of 20% ROE as a fixed deposit that consistently pays an interest of 20% or higher, year after year!

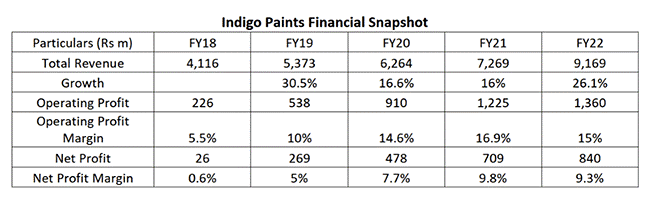

#2 Indigo Paints

Next on our list is Indigo Paints.

Established in 2000, it is one of India’s fastest-growing paint companies.

Despite being a late entrant into the sector, the company is the fifth largest player in the decorative paint segment.

It has four manufacturing facilities in India with a total installed capacity of 110,000 kilo-litres of liquid paints and 138,000 metric tons of power paints and putties.

The company manufactures a wide range of products, including emulsions, enamels, wood coatings, primers, distempers, cement paints, and putties.

It focuses on innovation and product development. Indigo Paints was the first to launch metallic paint for walls and floor paint that can withstand vehicular traffic. In the last two years, it has launched six new products.

The company’s zeal to deliver new and innovative products has driven its growth over the years.

Indigo Paints’ revenue has grown at a CAGR of 17.4%, primarily led by high realizations. While its net profit has grown at a whopping 100.4% (CAGR) during the same time.

The company is building a robust and responsive supply chain to strengthen its market presence.

Currently, it has a network of over 15,000 dealers across tier 3 and tier 4 cities. It is now focussing on tier 1 and tier 2 cities to increase its reach by expanding its dealer network.

Indigo Paints invested aggressively in building its brand. It has catchy advertisements featuring its mascot ‘Zebro’, a colourful zebra, to market its differentiated paint solutions.

Going forward, Indigo Paints expansion into tier 1 and 2 cities and stabilising raw material prices will drive its revenue and margin growth.

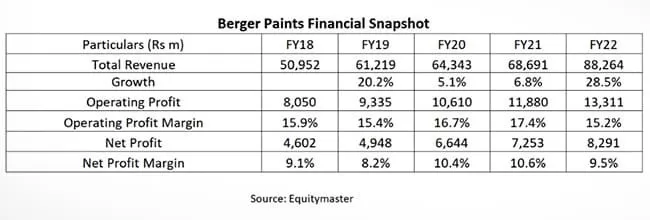

#3 Berger Paints

Last on our list is Berger Paints.

Established in 1923, it is one of the oldest paint companies in India. In its century-old existence, it has grown to become the second-largest paint manufacturer in India.

The company offers its customers paints for decorative and industrial use, waterproofing solutions, and express painting services.

Over the last few decades, the company has judiciously built a strong distribution network. It has a network of over 50,000 dealers and retailers, making its product available to its large customer base in India and other countries.

Its focus on improving product portfolio through innovation has led to technological tie-ups with companies such as DuPont and Nippon Bee Chemicals.

Berger Paints also holds a dominant position in the automotive coating segment. It is a major supplier to Hero Motors, Eicher, Tata Motors, and Mahindra and Mahindra, etc.

In the last five years, the revenue has grown at a CAGR of 11.6% driven by volumes. Its net profit also grew at a CAGR of 12.6% during the same period.

Currently, Berger Paints has a market share of 18% in the Indian paints market. It is planning to increase this through capacity expansion.

The company is setting up a greenfield plant in Uttar Pradesh and West Bengal to increase its capacity by 33%. It is also expanding its capacity in some of its existing plants.

The company is also focussing on the luxury product segment and aims to become one of the top players in the industry. It has launched several products in line with its goal, which helped the company expand its margins.

Going forward, capacity addition will drive its revenue and profit growth.

Why you should include paint stocks in your portfolio

The Indian paint industry has always grown at a double-digit CAGR over the last two decades. It was only in 2020 and 2021 that the paint sector was hit, mainly due to the pandemic.

However, the pent-up demand from the last two years has led to higher sales for the industry, leading to a faster recovery.

The industry is all set to go back to pre-Covid growth levels. This is mainly due to growing demand from the construction industry and rising infrastructure activities in the country, providing greater opportunities for the Indian paint sector.

However, there are other factors to consider as well. High crude oil prices affect the margins of the paint companies, and high inflation might reduce the purchasing power of consumers, which might reduce housing demand.

Hence you should be careful before investing in paint companies.

Happy Investing!

(Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.)

This article is syndicated from Equitymaster.com